How Does Algorithmic Trading Work?

Following the birth of the microprocessor came algorithmic trading in the early 1970s. Today, algorithmic (algo) trading accounts for roughly 80% of everyday stock market trades in the United States. Likewise, it’s responsible for about 92% of forex trades.

So, learning this investing technique is crucial to getting a leg up in the financial trading world.

Understanding how algorithmic trading works

To understand the process of algorithmic trading, we need to break down what algorithms are and how they’re used.

What are algorithms?

An algorithm is a set of rules used for executing a computation. In simpler terms, algorithms are a list of instructions for a computer to follow. They generate steps to conduct specific actions in either software or hardware-based routines.

How are they used in the world of trading?

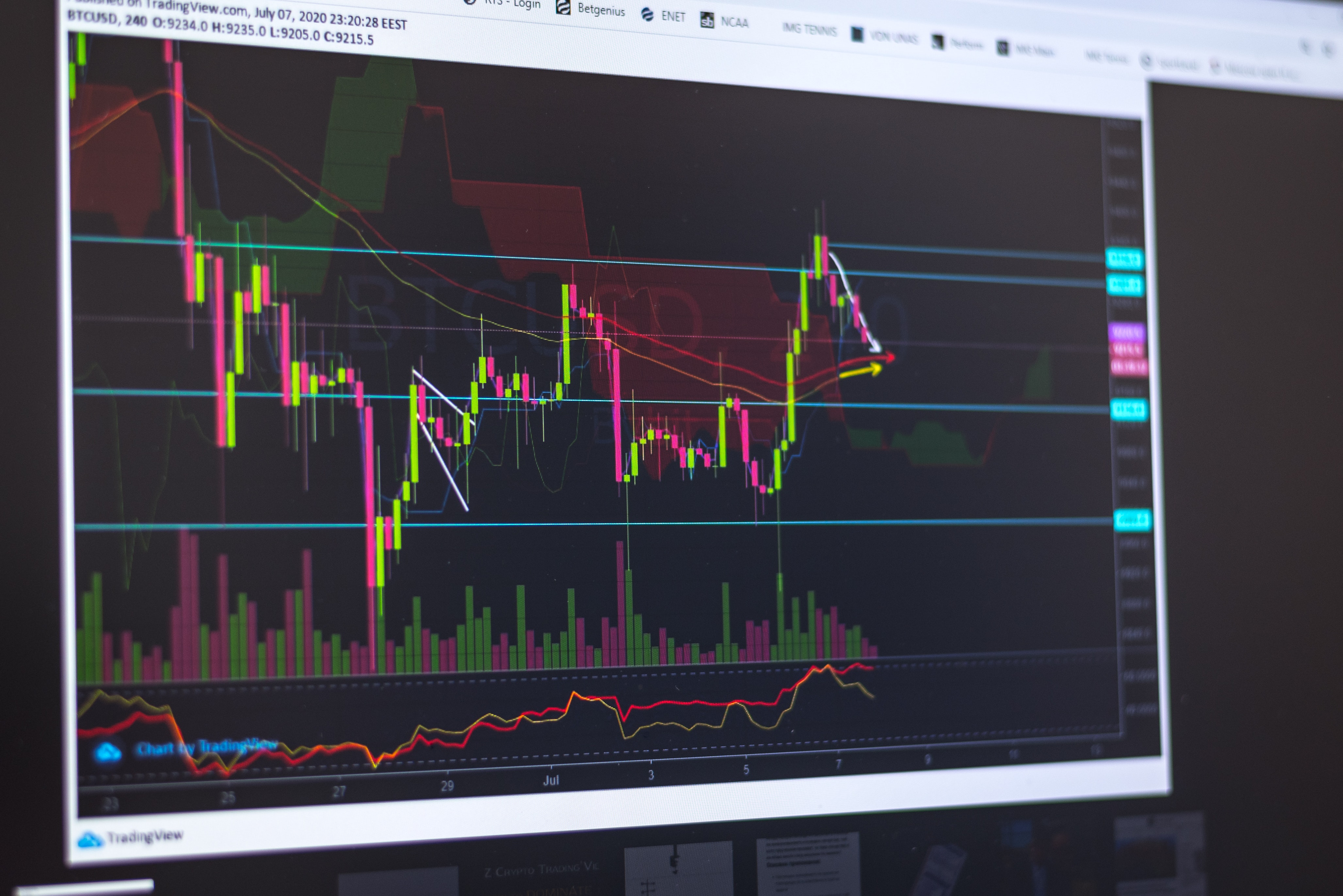

Algorithmic trading companies are used by firms and individuals every day. In the financial market, algorithmic trading works by automating buy and sell orders. These orders are encoded into a computer as algorithms.

So, what exactly is algorithmic trading?

Algo trading is an investing approach that uses a computer program to automatically place trades. The computer follows preprogrammed rules to search the market for optimal trades. In a nutshell, your computer does all your trading for you.

There are many benefits to using algo trading and minimal limitations. We’ll give a brief overview of the primary advantages first.

Advantages

Algo trading is the superior approach to making trades. Its alternative, manually placing trades, is time-sensitive and more prone to making mistakes. So, unlike their counterpart, algo trading has the time to scan the market every minute of every day. It also has a very diminutive risk of failure.

The most talked about advantage of algo trading is its ability to place logic over emotion.

Logic > Emotion

When placing manual trades, two common investor emotions are fear and greed. But, human emotion takes a backseat to logic with algo trading. Thus, it’s how algorithmic trading works efficiently and rationally.

Automating trades obstructs emotions from muddying up the decision-making process. Thus, crypto algorithmic trading, or algo trading in any other market, prevents emotions from affecting the outcome of a trade.

It’s easy to program a set of rules to take predictable, emotional responses out of the equation, such as fear and greed. But what about unpredictable, emotional reactions? How does algo trading account for the more erratic human responses?

This is where the behavioral finance theory comes in.

Behavioral finance theory

In the high-stakes world of trading, people make irrational decisions all the time. But, efficient markets depend on participants to act rationally. Thus, creating automated trades needs to be able to combat irrational behavior.

This theory states that humans respond irrationally to similarly situated events, which means that their irrational reactions are similar to one another. As a result, unpredictable behavior in the market can actually become predictable. Here’s how:

Identifying irrational decisions that humans make in the market creates patterns. In turn, these patterns act as statistical indicators that trigger algorithms to take a programmed action. This is how algo trading recognizes anomalies in market behavior. It's also how it enables logic to take precedence over human emotion and impulsivity.

Diversification made easy

Algo trading makes diversifying risk easy. It accomplishes this by executing trades with a variety of strategies across markets. Algo systems scan different markets and place orders simultaneously through multiple timeframes. This enables risk spreading and boosts diversification.

Fast trades

Algorithmic trading works at exceptionally rapid rates. Trades can be identified and placed in a split second. Even a superhuman dealer can only put in 4 orders per second at best. But, automated systems can put in thousands of orders every second.

Trade while you sleep

While you likely need 7 or 8 hours of sleep, your algo system doesn’t need any. This means that your algorithms can search the markets and take trades every second of every day.

As a result, algo trading in crypto markets is becoming increasingly popular. This is due to how time-consuming crypto trading can be when done manually.

Setbacks

The main disadvantage of automated trades is that there’s a chance the computer could make an error.

Possibility of error

Any process executed by a computer is prone to bugs and glitches every now and then. This can lead to making wrong decisions and in turn, cause you a loss. However, these simple errors are pretty easy to fix– just make sure you monitor your system from time to time.

Now that we’ve covered what algo trading is and the advantages and limits that come with it, let’s dive into how it works.

How does algorithmic trading work?

Algo trading combines computer software and financial market strategies to execute trades. Trades are automatically placed based on encoded logic or a set of rules.

How the rules are set

Rules are programmed to act as specific trading instructions. Then, they're stored as algorithms in the trading software.

Traders come up with their predetermined rules by considering certain variables. Example variables could be price, time, and volume. This is how they develop a set of rules to create a trading strategy.

How the rules are executed

So, how does algorithmic trading work once the rules are set? Following the rules, your computer scans the market for qualifying trades. Then, it’ll execute trades when the predetermined conditions are met.

Pretty easy, right? It is once your computer begins running the show. But first, you need to figure out what your trading strategy is and then create algorithms from it.

How hard is algo-trading?

In the past, algo trading typically appealed to the most tech-savvy investors. It was a luxury that only the biggest and brightest corporations could leverage.

But, in recent years, software engineers have taken steps to simplify algo trading. Today, there are many algorithmic trading books and tools available for the everyday investor.

How to develop a trading algorithm

Learning how algorithmic trading works takes time and discipline. You can come up with an algorithmic training model by taking an online training course. Once you’ve established the criteria for your trading strategy, you’ll have to encode it into your computer and then backtest it.

Backtesting

Backtesting uses historical market data as a way to test trading models. As a result, it provides information about how the algorithms have performed in the past. So, before you launch your system to trade a live account, make sure you backtest it using previous price action of up to 10 years.

How do algorithmic trading strategies work?

There are many algo trading strategies on the market. We’ll go over three of the most popular ones used by traders every day.

Mean-reversion strategy

This strategy works on the basis that the price of an asset over time will return to the average. In other words, it assumes that the high and low price points of an asset are temporary phenomena that revert to their average value.

Trend-following strategy

This type of strategy works to profit from tracking trends in technical indicators. These indicators may include moving averages or price level fluctuations. An example of how algorithmic trading works with this strategy would be using 50-day or 200-day moving averages to detect instances of desirable trends.

Breakout trading strategy

This strategy seeks to leverage the increase in price momentum following a breakout. For instance, with respect to this strategy, you could create an algorithm to buy when the price closes above a predetermined level. Likewise, you could develop an algorithm to buy on the open of the succeeding candlestick after the breakout candlestick.

The bottom line

Algorithmic trading works to generate profits at a much higher frequency, and speed than human traders are capable of. Over the past few years, this enticing approach to the investing world has become available to everyday traders. Thus, algo trading is how the modern investor stays ahead of the game in the trading markets.