Guide to Stock Pattern Recognition

There are a number of standard patterns we see when dealing with technical analysis of different markets, and understanding the different types of patterns and what they mean can help you invest much more successfully.

Learning to improve your stock pattern recognition isn’t tough, but it does take some time and effort to make meaningful inferences from what you’re seeing in the chart. Each type of pattern signals something different, and one may tell you to buy while another tells you to sell. Let’s look at some of the common stock patterns you’ll deal with when investing and what they mean for you.

What are Trade Patterns?

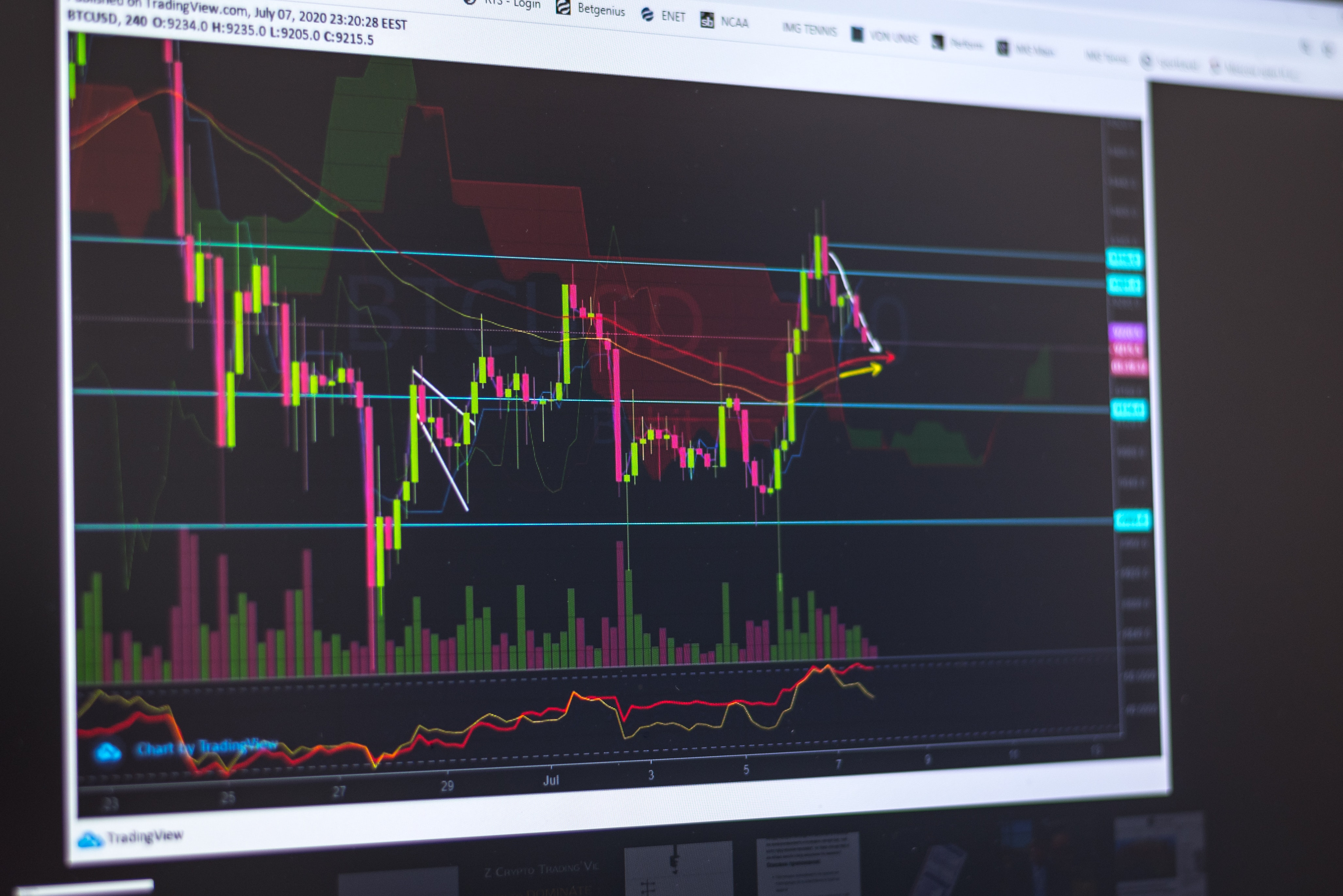

If you spend any time looking over charts, you’ll find that patterns emerge. It doesn’t matter whether the chart relates to stocks or sports scores. When we look deeper into stock patterns, we can infer certain things about those stocks. Some may indicate continuing trends, others indicate reversals, and some point to high volatility in the market. Increasing your abilities in stock pattern recognition is the best way to understand the patterns and use them to your full advantage.

Quite simply, a trade pattern is formed by at least two trend lines, which may be straight or curved. These trend lines are established by connecting the highest price points at the top to create a resistance line and the lowest prices at the bottom to create a support line for that particular stock over a period of time. Traders use the patterns formed by a stock’s price fluctuation over a defined period of time to predict where it will go in the future.

Who Uses Trade Patterns?

While anyone who invests in securities can find use in stock pattern recognition, they are primarily used by investors who perform technical analysis on the companies they choose to invest in. If you don’t know what technical analysis is, here is a brief explanation of what fundamental and technical analysis are, as well as the difference between the two.

Fundamental Analysis

Fundamental analysis is a more conservative means of studying every aspect of a company to determine its intrinsic value. The idea is that if things like a company’s leadership team, profit and loss statements, and intellectual property are strong, so is the company. If you can get stocks at a value lower than that of the intrinsic value, you are getting a deal. If the price is too high, you’re better off waiting. The other side of the stock analysis spectrum is technical analysis.

Technical Analysis

If you base your trades on technical analysis, then you are using the charts themselves to help you decide when to buy and sell stocks. Adherents of technical analysis believe that stock market chart patterns tell them everything they need to know about the strength of a company and that stock pattern recognition will tell them when it’s time to buy and when it’s time to sell. In order to make the most of that information, you have to know a bit about what each trade pattern means.

Stock Pattern Recognition Guide

While one can see many patterns and images in a chart, not all of them mean anything. Like constellations, there are groups and patterns that mean much more to those who study the field. There are a lot of different patterns that professional investors use, but some types of stock chart patterns mean more than others.

Each different type of stock pattern is broken up into one of each three categories. They are continuation, reversal, and bilateral patterns. Let’s take a quick look at what each type indicates.

Continuation Patterns

This type of pattern indicates that the trend you’re seeing currently is likely to continue after a brief consolidation period. That period is indicated by the continuation pattern itself. It’s not a hard and fast rule, but many traders look for continuation patterns to tell them when to buy into securities.

Reversal Patterns

On the other hand, a reversal pattern generally indicates that a trend will change directions. Whether that means an upward trend is likely to experience a downturn or a downward trend is ripe for a boost, reversal patterns are good things to look out for if you’re thinking about buying or selling securities.

Bilateral Patterns

There is another type of pattern that indicates uncertainty, and that type is known as a bilateral pattern. Bilateral patterns are good indicators that uncertainty and volatility exist in the future of the stock price and that you should invest with caution.

Top Types of Stock Patterns

There are a number of patterns that you should pay particular attention to, and they comprise the primary types we’ll cover in this stock pattern recognition guide. Let’s take a look.

Continuation Patterns

Whether you’re waiting to get the most out of your investment or trying to get out before a stock plunges too low, continuation patterns are a great tool to help identify trends that are likely to continue. Here are four popular patterns to look for.

Triangles

One type of chart patterns you should be aware of is the triangle. Triangle patterns are continuation patterns, which means they generally indicate a continuation of an existing trend. There are three main types of triangle patterns, and they are ascending triangles, descending triangles, and symmetrical triangles. If the price is trending up, it’s known as an ascending triangle, and if it’s trending down, it’s known as a descending triangle.

Ascending Triangles

Ascending triangles are seen when upward trending securities briefly move sideways before likely continuing upward. An ascending triangle is defined by a relatively flat upper trendline and an ascending lower trendline.

Descending Triangles

Descending triangles are exactly the opposite. They are generally seen in a downward trend and are defined by their relatively flat lower trendline and descending upper trendline.

Symmetrical Triangles

Unlike other types of triangle patterns, symmetrical triangles are generally considered bilateral patterns and are formed by support and resistance lines that follow symmetrical slopes. They can indicate bullish or bearish breakouts and indicate uncertainty in the market.

Pennants

Pennants are symmetrical triangles and usually occur immediately following a sudden jump or drop in price rather than a gradual increase or decrease. A pennant pattern usually indicates a trend will continue after a brief consolidation period.

Wedge Patterns

Wedge patterns look a lot like symmetrical triangles but are differentiated by a significant upward or downward slant. Wedge patterns act a little differently from some of the other patterns on the list. They can signal either a continuation or a reversal, depending on which type of wedge pattern you’re looking at and whether that pattern follows a bullish or bearish trend.

Rising Wedges

In a rising wedge pattern, both the support and resistance lines slope upward. The support line is sloped more dramatically than the resistance line, forming an apparent symmetrical triangle that points upward. Rising wedges are generally seen as bearish, whether they follow a bullish or bearish trend.

Falling Wedges

On the other hand, falling wedges point downward, with a steeper slope on the resistance line than on the support line. Falling wedges generally indicate a bullish breakout, whether they follow a bullish or bearish trend.

Flags

Another type of stock pattern we see immediately following a sudden increase or decrease in price is the flag. Flags differ from pennants in that they are characterized by parallel trend lines that go against the preceding trend. If the trend is up, the lines that make the flag will slope down, and if the trend is down, the flag will slope up.

Rectangles

Rectangles look similar to flags but are different in a couple of key ways. First, rectangles generally follow a gradual price trend rather than a sharp increase or decrease. Also, whereas flags tend to go against the prevailing trend, the channel created by the upper and lower trend lines run parallel and horizontal.

Reversal Patterns

When it comes to stock pattern recognition, reversal patterns are important trends to understand. Keep an eye out for these reversal patterns to key you in on when a trend is likely to turn around.

Head and Shoulders

Head and shoulders patterns are thought to be among the most reliable reversal patterns, so it’s a good place to start. These types of trading patterns are identifiable by a large center peak flanked by two smaller peaks. The inverse of a head and shoulders pattern is exactly the opposite, where there is a large valley in the middle, flanked by a smaller one on each side.

Double Top and Double Bottom

Another popular reversal pattern is the Double Top or Double Bottom. These patterns form when the prevailing trend reaches a peak or valley, returns to the support or resistance lines, hits that peak again, and reverses course.

Cup and Handle

If you’re into security for the long term, you’ll want to keep your eyes out for cup and handle patterns. This type of pattern takes much longer than some of the others to show itself, sometimes months or years, and is a fairly good indicator of a reversal.

You can spot a cup and handle by a U-shape in the chart, followed by a slight drop at the end of the U.

Rounding Bottom

If you see a gradual drop in a stock price that eventually rounds out at the bottom, as opposed to quickly jumping up again, it’s a good indicator that a reversal is imminent. It is possible for a rounding bottom to show a “V” at the bottom, but it should not be too sharp and should take a period of time to develop.

Bilateral Patterns

Some traders consider all types of triangles bilateral patterns, but others only consider symmetrical triangles to be bilateral. Whichever you prefer, good stock pattern recognition requires that you understand that some patterns could mean volatility in the market.

Symmetrical Triangles

A symmetrical triangle is different from ascending or descending triangles in that both trend lines are converging. As the exit point narrows, uncertainty grows as to whether the price will rise or fall. Some traders hedge their bets by setting their stock pattern recognition software to place orders when the price reaches either of the trend lines.

Any type of triangle can be more likely to be a continuation pattern, but the chances are close enough that they are often classified as bilateral patterns quite often.

Rectangles

Another chart pattern that can fall into either the continuation or bilateral categories is the rectangle. When a stock price becomes static for an extended period, we see a rectangle pattern. This is indicated by long, parallel support and resistance trend lines that create a rectangular box.

Any breakout is slightly more likely to continue the trend, but it’s not a safe bet, and rectangles always carry a reasonable possibility of a reversal.

Don’t Rely Upon These Patterns Alone

There are other types of patterns out there, and professional trading pattern recognition algorithms will take them into account when recommending buying or selling. Stock pattern recognition is an important skill for investors at any stage, but no pattern is fail safe. Don’t invest money you can’t afford to lose. For more in-depth analysis and advice, invest in a robust trading tool like Chart Prime to take your technical analysis to the next level.