Identifying The Cup And Handle Pattern

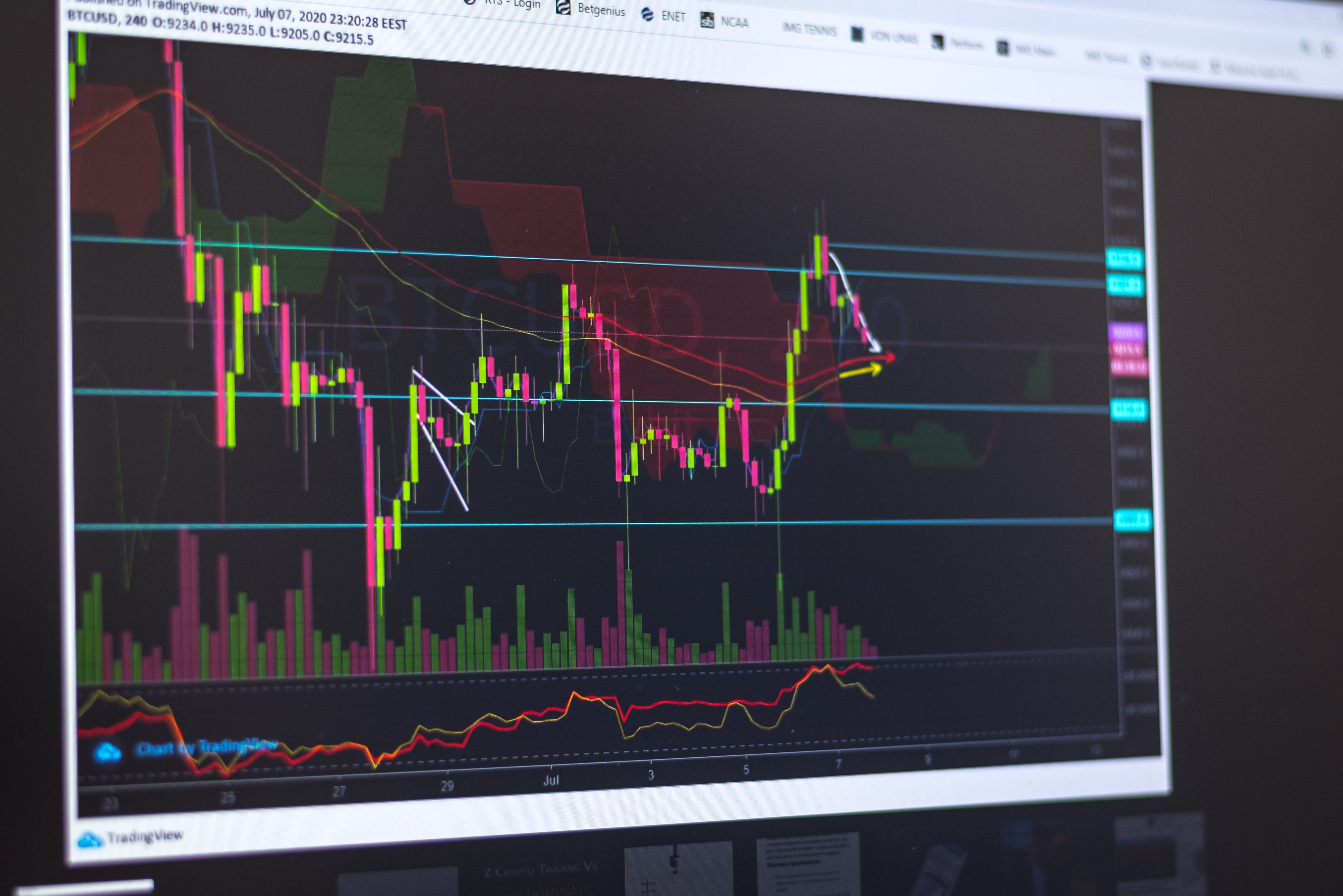

If you’ve ever looked at stock or crypto charts and identified interesting patterns in the graph, you aren’t alone. In fact, there is a whole subset of investors who rely upon these patterns to inform their trading decision. The practice is called technical analysis, and there are dozens of patterns that have significant meaning in that world. The cup and handle pattern is one of them.

If you’re unfamiliar with technical analysis, it’s a pretty simple concept. We use patterns in the stock and crypto charts to indicate which direction the price will head. If a pattern historically precedes an upward trend, it triggers us to buy. If it typically appears before a downward trend, it will trigger a sell.

The cup and handle pattern is one of the more reliable patterns we see. Let’s look at what it is, what it indicates, and how we interpret its meaning.

What is a Cup and Handle Pattern?

First and foremost, let’s look at what a cup and handle pattern is. The cup and handle stock pattern was first described in the 1988 book, How to Make Money in Stocks by William J. O’Neil. This type of pattern, not surprisingly, resembles a cup and handle. A U-shaped “cup” is immediately followed by a downward drift. That drift is the handle.

Identifying Cup and Handle Patterns

If you think you see a cup and handle forming, you'll want to know the basics before moving on this potential pattern. First, in order to be considered a continuation pattern, you should see evidence of a trend preceding it. If you see a random cup and pattern formation without an upward trend, be cautious. If it does appear to be following an upward trend, check to make sure it meets these other criteria.

In a true cup and handle, the first thing we see is a noticeable drop, followed by a stabilizing period. That means you’ll see the price trend down, then move sideways for a period of time. The stock will then rise to approximately the same resistance line it was at before the drop. This forms the u-shaped cup. If you see that cup followed by a downward drift, it may be primed for a bullish breakout.

Handle and cup patterns have historically preceded big gains in many stocks. They can take hours to develop, or they can take a year or more. That can make them hard to spot, but due to their relative rate of accuracy, they’re worth taking notice of. Here are a couple more things to check when determining whether or not you’ve got a true cup and handle.

How Deep is the Handle?

In a true cup and handle pattern, the handle won’t dip too low before rebounding. Ideally, the handle should not dip more than one third of the way down into the cup. If you see the price plunging below this line, you may want to avoid it.

Is the Bottom V-Shaped or Rounded?

The shape of the bottom of your cup can be a good indicator of a weak vs strong pattern. If the bottom of your cup has a pronounced “V” shape, you may be looking at fool’s gold. Look more for an extended period with a narrow trading range. It doesn’t have to be incredibly smooth, either. Some ups and downs are to be expected. The important thing is that you have a long, narrow trading range.

What is an Inverted Cup and Handle Pattern?

An inverted cup and handle looks just like a regular cup and handle, flipped upside down. These signals usually occur following a down trend, and often take 3-6 months to fully develop. They display the same trademarks as a standard cup and handle. You’ll see a cup—a well-defined rounded top bounded by two steep sides. You'll also see the handle on the back end. In an inverted cup and handle, however, the handle will drift upward.

We mentioned earlier the fact that cup and handle patterns are bullish. But what about the inverted cup and handle? Is the inverted cup and handle pattern bullish too? Unfortunately, the answer is no. Inverted cup and handle patterns are considered bearish continuation patterns and often trigger a sell signal.

Being aware of inverted cup and handle patterns can help you avoid big losses. They can be just as important as a standard cup and handle in protecting your investments.

Trading the Cup and Handle

Trading cup and handle patterns can feel daunting if you’re new to technical indicators. What is it telling you? How should you respond? To get to the answer, we must dig into the way cup and handle patterns are formed in the first place.

What is Cup and Handle Pattern Saying?

As a bullish continuation pattern, cup and handles represent a correction in an upward trend. Since upward trends rarely continue unabated, prices usually experience corrections. There is basic psychology behind the way the cup and handle works. That’s why it’s seen as such a reliable pattern. Here’s how it works.

When the price of a stock is on an upward trend, it can elicit some complicated emotions. We are excited by the newfound rate of return but fear the bubble could burst at any time. This leads some investors to sell and take their profits. That brings the price down for a spell.

The price will hover at that low point as long as there is pressure to both buy and sell. Eventually, the buyers take over and it begins to climb again. Once it reaches the previous resistance level, you’ll lose a few more skittish investors. This marks the end of the correction, and the upward trend tends to continue, historically speaking.

The cup and handle pattern represents a correction in both price and time. Unfortunately, there is no standard definition for what exactly a correction is. But, most agree that a correction brings prices more into line with long term projections. Here’s what the price and time corrections look like in a cup and handle pattern.

The Price Correction

Price corrections bring the vertical axis down. The dip that forms the left side of the cup indicates the price correction. The price was trending unsustainably high, and it has corrected to be more in line with long term goals.

The Time Correction

Time corrections extend the price along the horizontal axis. Thus, the rounding bottom represents the time correction. A time correction occurs when the trading range remains stagnant for an extended period. This sideways movement brings the growth pattern to a more sustainable level.

Define your Cup and Handle Strategy

If you’re seeing a cup and handle pattern emerging, you’ll want to define your strategy before you buy. You’ll have to decide whether or not you’ll take any action whatsoever. Beyond that, you’ll need to define when you want to buy in and when you want to get out. Look at these considerations before making any moves.

Do You Want to Buy?

The first question you’ve got to ask is whether or not you want to buy. If you see a cup and handle pattern, ask yourself how you feel about the stock. Is it something you want in your portfolio? Not all stocks break out for the same profits as others.

Even if a stock isn’t in your usual wheelhouse, you may want to consider getting in. If you see a well-defined cup and handle pattern on a solid company, it could render big rewards. You’ve just got to decide your buying and selling points.

Set Cup and Handle Pattern Targets

The right time to buy and sell with cup and handle patterns depends upon the individual making the trade. Some prefer to use the horizontal trendline that makes up the two highpoints on the cup. Others use the resistance line of the handle. Either way, once the price breaks past your trendline of choice, it’s time to buy. The cup and handle formation is complete, and you’ll hopefully start to see big returns on your investment.

The cup and handle is a fairly accurate indicator, but that doesn’t mean it’s 100%. It’s important to have a stop-loss in place in case the price drops and invalidates the pattern. You don’t want to put all your eggs in one basket and crash on a cup and handle pattern failure.

Keep in mind that no pattern is foolproof. Even the most well-defined patterns can be misleading. Don’t invest more than you are willing to lose.

Talk with Trading Pros

If you’re unsure of what you’re looking at, it always helps to get a second opinion. Not sure whether you’re looking at a cup and handle pattern or a simple rounded bottom? Talking with trading pros can give you additional insight before pulling the trigger on any trades. They know technical indicators and can help you identify patterns when they appear. A great trading platform can also help.

Today’s trading applications are set up to alert you when conditions are ripe for change. They can teach you how to make informed trades and give you the tools to stay in the loop. Choosing the right platform might just make you a good chunk of change.